State of NJ is the Biggest Winner in the Surge of Internet Gaming

By Jane Bokunewicz, Ph D, Director, Lloyd D. Levenson Institute of Gaming Hospitality & Tourism

Internet gaming was a lifeline for New Jersey casinos during COVID, and it is increasing in importance as a share of total gross gaming revenue (GGR) for them. Perhaps the biggest winner, however, since its legalization, is the State of NJ. In 2022, Atlantic City’s casinos generated approximately $2.8 billion in GGR from in-person gaming operations

Jane Bokunewicz, PhD

Faculty Director, Lloyd D. Levenson Institute of Gaming Hospitality & Tourism; Professor, Hospitality and Tourism Management Studies, Stockton University

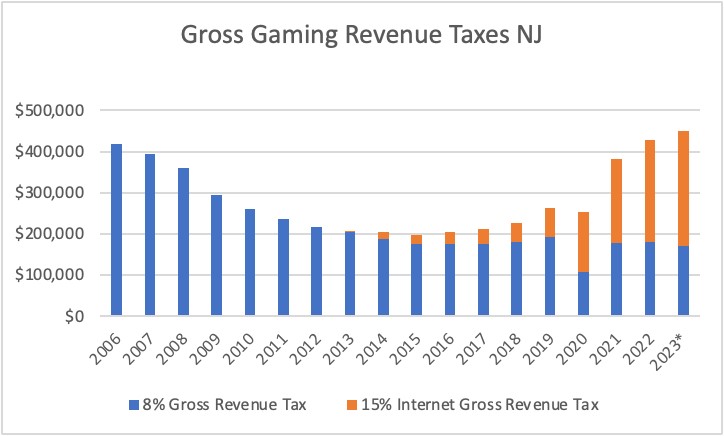

– far from the peak $5.2 billion generated from those same operations in 2006. Despite this, total gaming taxes for the state reached a new high in 2022 – at $449 million they exceeded the 2006 peak by 8.9% – and are on track to set new record highs in 2023. The majority of this new tax revenue comes from internet gaming.

While it started out slowly in the early years, internet gaming has grown in importance as a revenue stream for Atlantic City casinos — generating $6.3 billion in revenue since its inception in 2013. The growth of internet gaming accelerated during the pandemic when in-person gaming was suspended for three months, and internet gaming was the only option. Through 2019, internet gaming generated less than $500 million per year, but in 2020 during the pandemic, revenue jumped to $970 million. In 2021 and 2022 when casinos were reopened post-COVID, internet gaming exceeded $1 billion, generating $1.4 billion in 2021 and $1.7 billion in 2022. As of June 2023, internet gaming has generated $930.8 million in revenue. This represents 38% of total gross gaming revenue for Atlantic City’s casinos in that period.

The increased volume of internet gaming play, coupled with the higher tax rate (15% on internet gaming compared to 8% on slots and tables revenue), led to a substantial increase in total gaming taxes collected by the state of NJ – particularly post COVID.

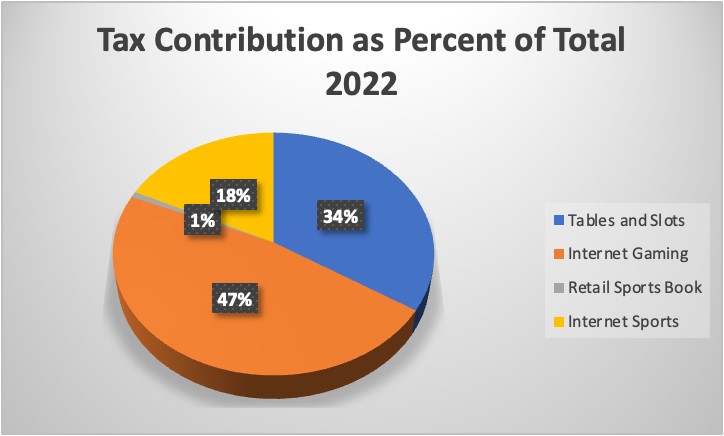

At 47%, taxes from internet gaming now represent the biggest share of the total gaming revenue taxes collected by N.J. from Atlantic City casinos. If the internet portion of sports wagering at the casinos is also considered, then taxes collected from online wagering activity represent 65% of total gaming taxes paid by Atlantic City Casinos to the state of N.J.

Where do state tax dollars go?

When casino gaming was legalized in NJ it was written into the law that the 8% tax on gross gaming revenue would be deposited into the Casino Revenue Fund and used exclusively for programs benefitting seniors and persons with disabilities. This holds true for taxes collected on the subsequent legalization of internet gaming and sports betting. Casino Revenue Fund-Supported Programs include the following: [1]

- Community Care Waiver – Individual Supports

- Statewide Birth Defects Registry

- Vocational Rehabilitation Services

- Hearing Aid Assistance for the Aged and Disabled

- Pharmaceutical Assistance to the Aged and Disabled

- Personal Assistance Services Program

- Community Based Senior Programs

- Transportation Assistance for Senior Citizens and Disabled Residents

- Adult Protective Services

- Homemaker Home Health Aide Certification Program

Casino Reinvestment Development Authority (CRDA) taxes

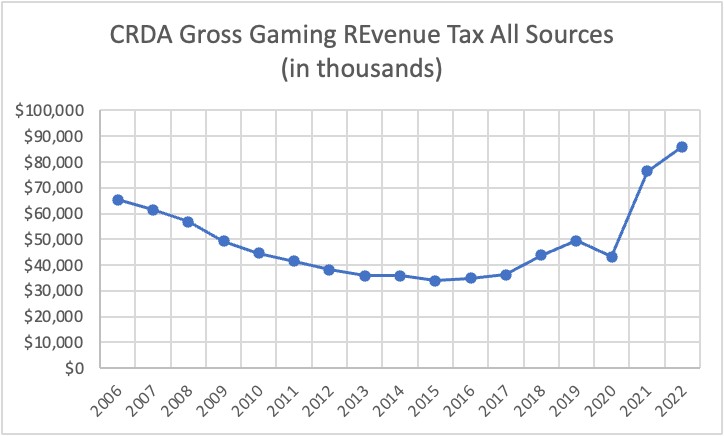

As well as the taxes paid by casinos to the state’s Casino Revenue Fund, an additional 1.25% of Casino Gross Gaming Revenue and Sports Wagering Gross Revenue (retail and online), and an additional 2.5% of Internet Gross Revenue gets paid to the Casino Reinvestment Development Authority (CRDA). These revenue streams are used for redevelopment of the Atlantic City Tourism District, and marketing and promotion of the resort.

Because of the increase in volume of internet gaming revenues, and the higher tax rate of 2.5% on those revenues, CRDA taxes collected also hit a record high in 2022. Total CRDA taxes collected from all gaming types combined was $86 million compared to the peak of $65 million in 2006 when Atlantic City casino revenue was at its highest point.

CRDA dollars have been used to fund important projects that diversify and improve Atlantic City’s redevelopment efforts. Some recent examples are Stockton University’s Atlantic City campus, the Island Waterpark at Showboat, Atlantic Care Medical Arts Pavilion, and nongaming amenities at various casino properties. The additional funds provided by the increase in internet gaming could be used for much needed city improvements that would solidify Atlantic City as a first-class tourism destination. Some examples of projects that are desperately needed are improvement of city roads and sidewalks, affordable housing stock, and removal of blighted properties.

Internet gaming has substantially increased tax revenue for the state of New Jersey’s Casino Revenue Fund and for the CRDA. To ensure the sustainability of this revenue stream, which is so vital in funding important programs as well as supporting marketing and redevelopment of the tourism district, the state must continue to support the casino industry’s internet gaming efforts. The five-year extension of the legalization of internet gaming in N.J. was a big improvement over the two-year extension that was once proposed. However, to ensure continued development in internet gaming products and further investment by casino operators, more permanent legislation is needed.

Works Cited

[1] 2019 Annual Report Casino Revenue Fund Advisory Committee https://www.nj.gov/casinorevenue/reports/crfacannrpt/2019.pdf